The coronavirus era may have months yet to run, but the worst of its impact on Dell Technologies and Dell’s channel appears to be in the past.

Following a fiscal second quarter in which sales through partners of client and infrastructure technologies dropped 6%, channel-related revenue for the hardware giant rose 1% globally in the third quarter, which ended October 30th, and 4% in North America.

“We saw really good improvement in Q3,” says Cheryl Cook, Dell’s senior vice president of global channel marketing. Partners are helping Dell expand market share as well, she adds, noting that 60% of the company’s new or reactivated buyers last quarter came through the channel.

“In an environment like we’re in now where finding a new customer might be a little more challenging than otherwise and you’re doing things via Zoom and remote, really expanding existing relationships, and leaning in and cross-selling or upselling into other lines of business, is proving to be an avenue of growth for our partners,” Cook says.

Some of Dell’s Q3 numbers look significantly better when you break its overall figures down. Sales through the channel of both servers and client products, including PCs and monitors, for example, were up 6% worldwide. According to Cook, moreover, demand for work-from-home hardware isn’t alone in driving that uptick in the client business. Companies are restarting temporarily stalled projects in areas like edge computing now as well.

“I think the world has just settled down a little bit,” Cook says. “There’s still a need for our customers to be able to enable themselves to not just deal with the current climate around working remote, but advance some of their projects and initiatives that our partners are really well positioned to help support.”

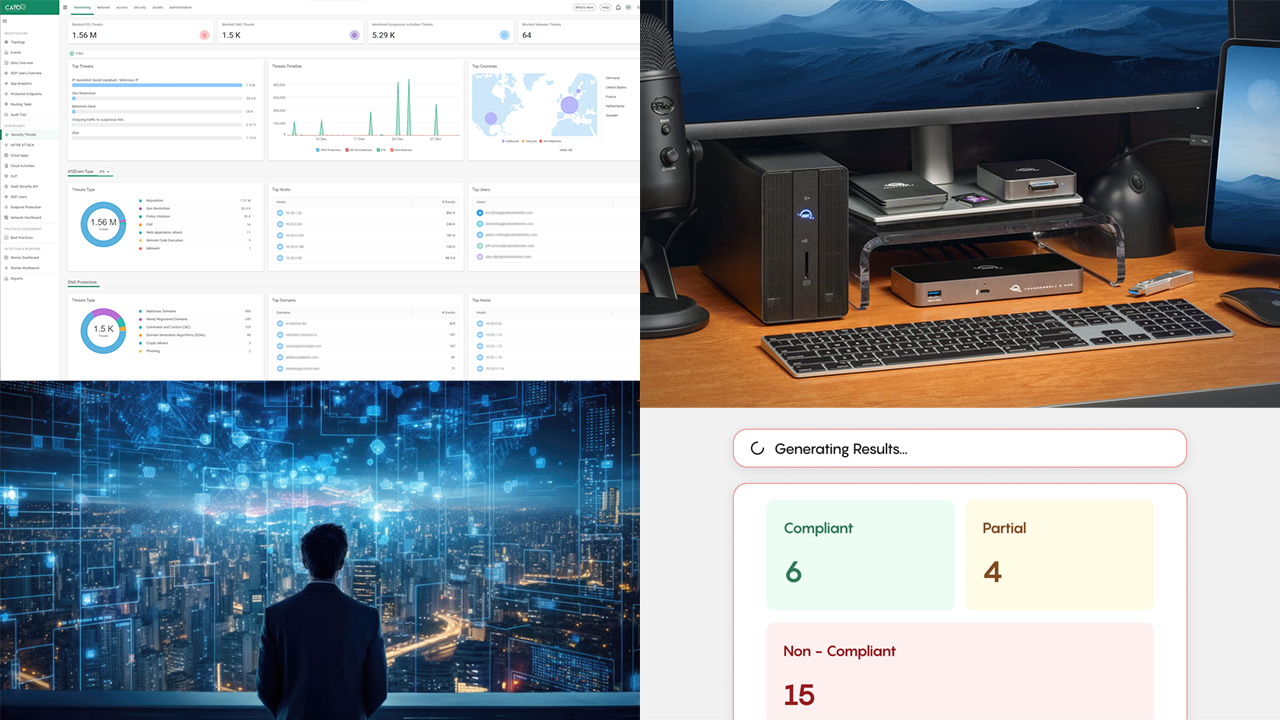

Businesses are also investing in security for all the work-from-home devices they bought earlier in the year, Cook continues. “You’ve got a lot of people realizing that this environment will persist much longer than we thought it might. It’s not just a temporary or an interim phenomenon, and they are hardening those environments.”

On the server side, fast climbing orders from organizations in verticals like education, healthcare, and state and local government are compensating for still weak sales in sectors like retail and hospitality hit hard by COVID-19 lockdowns.

Not all of the news for Dell in Q3 was positive. Global sales of storage solutions through the channel, which have been slowing for much of the last year, dropped 10%. Cook, noting that revenue from high-end storage systems was actually up for the quarter, points to tepid results in the midrange market as the source of the segment’s poor aggregate performance.

Dell is counting on the midrange PowerStore product set it introduced in May to turn that problem around. Buyers, according to Cook, are exhibiting strong initial interest in the new products so far. “It’s got the largest pipeline of any storage offering we’ve had in the company,” she says. “We’re now all focused around conversions.”

As added motivation in that effort, Dell rolled out new front-end incentives on PowerStore sales last month and a separate set of incentives for PowerStore deals involving net new accounts. A “tech refresh” program now underway aims to uncover additional midrange sales opportunities in companies with aging storage gear.

Utilization of Dell financing programs was up in Q3 along with the vendor’s channel-led revenue. Originations through the consumption-based Flex On Demand program specifically grew 32%, according to Cook, who notes that those gains preceded the introduction of richer Flex On Demand benefits in Q4. Resellers are in fact now eligible for front-end rebates worth up to 20% of contract value on storage and data protection sales and up to 10% on server transactions.

Partners will benefit as well, Cook says, from efforts begun in Q3 and continuing now to unify, simplify, and add more self-serve functionality to Dell’s quoting tools.

Though no one in these unpredictable times can forecast the future with confidence, Cook is optimistic about Dell’s fourth quarter, which concludes in January, and the rest of 2021. “The market opportunity is there,” she says, and channel pros have done a good job of capitalizing on opportunity when it appears since the pandemic began.

“In what all of us know is kind of a really interesting and somewhat challenging year. I continue to really be impressed and inspired with just the resiliency of our partner community and the level of engagement that we continue to enjoy with them.”