September 09, 2019 08:30 AM Eastern Daylight Time

FRAMINGHAM, Mass.–(BUSINESS WIRE)–A new forecast from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker shows signs of market recovery in the second half of 2019 and into 2020, pushing smartphone shipment growth back into positive territory. IDC expects shipment volumes to be nearly flat (-0.4%) in the second half of 2019 while the market declines 2.2% year over year for the full year, making 2019 the third straight year of global contraction. IDC expects shipment growth to reach 1.6% in 2020.

IDC expects worldwide smartphone shipments to decline 2.2% year over year for the full year 2019 and then turn positive in 2020 with 1.6% growth.

Tweet this

“The global smartphone market and relevant supply chains remain uncertain, largely due to fluctuations in U.S-China trade negotiations, making future planning even more challenging than normal,” said Sangeetika Srivastava, senior research analyst with IDC’s Worldwide Mobile Device Trackers. “Consumers continue to hold their devices for lengthier times making sales difficult for the vendors and channels alike. However, expectations of aggressive promotions and offers in the second half of 2019 aimed at helping to clear out any channel inventory and get consumers excited about the next wave of smartphone technology should steer the market back toward renewed growth.”

While global economic uncertainty mixed with constant trade/tariff threats continues to dominate headlines, a ray of hope has arrived for the smartphone world in the form of 5G. Commercial deployments have begun in many regions and while 2019 is very much an introductory year at best, 2020 looks to be the year where 5G begins to ramp up. IDC expects 5G shipments to reach 8.9% of smartphones shipped in 2020, accounting for 123.5 million devices shipped. This is expected to grow to 28.1% of worldwide smartphone shipments by 2023.

“The anticipation of 5G, beginning with smartphones, has been building for quite some time but the challenges within the smartphone market over the past three years have magnified that anticipation,” said Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers. “To be clear, we don’t think 5G will be the savior in smartphones, but we do see it as a critical evolution in mobile technology. We expect the 5G ramp on smartphones to be more subtle than what we saw with 4G, but that is primarily because we are in a much different market today. The biggest difference is the level of penetration we are at now compared to 2010/2011, specifically in China, the U.S., and Western Europe. The biggest change in our 5G forecast assumptions is that we have lowered average selling prices (ASPs), particularly in China. We also expect a wide range of sub-6GHz 5G smartphones with midrange prices to enter the market in early 2020, if not sooner.”

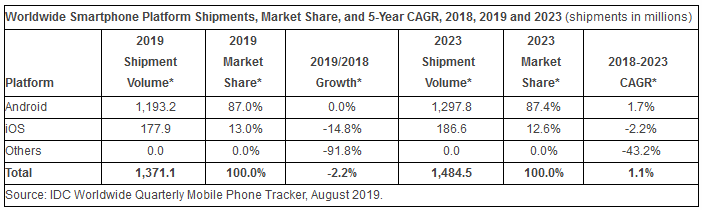

Platform Highlights

Android: Android’s smartphone share will increase to 87.0% in 2019 from 85.1% in 2018 mostly due to 5G launches and expedited inventory cleanup of older devices. Volumes are expected to grow at a five-year compound annual growth rate (CAGR) of 1.7% with shipments of 1.3 billion in 2023. Android ASPs are estimated to grow by 3.2% in 2019 to US$263, up from US$254 in 2018, with a push from the new devices becoming available in 2H19.

iOS: 2019 will remain a challenging year for iPhone shipments with volumes expected to drop to 177.9 million, down 14.8% year over year, mostly due to market maturity as well as a lack of 5G devices. However, Apple is likely to deliver 5G handsets later in 2020, which will pick up iOS volumes slightly as it will have an edge over other vendors with a better understanding of 5G market conditions for a much more planned launch.

[See table image]

* Table Note: Figures with asterisks are forecast projections and all figures may not be exact due to rounding.

In addition to the table above, a graphic illustrating IDC’s worldwide smartphone forecast by cellular network technology generation is available by viewing this press release on IDC.com.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools.

For more information about IDC’s Worldwide Quarterly Mobile Phone Tracker, please contact Kathy Nagamine at 650-350-6423 or knagamine@idc.com.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly-owned subsidiary of International Data Group (IDG), the world’s leading media, data and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn.

All product and company names may be trademarks or registered trademarks of their respective holders.

Contacts

Melissa Chau

+65 6829 7713

melissachau@idc.com

Sangeetika Srivastava

+91 80669 91000

ssrivastava@idc.com

Ryan Reith

+1 508-935-4301

rreith@idc.com

Michael Shirer

+1 508 935 4200

press@idc.com