HP Inc.‘s print supplies business may be down, but it’s far from out.

That at least was the message to partners this week at the vendor’s Reinvent conference, which wrapped up today in Houston. Though the disappointing ink and toner revenue the vendor reported last month at the conclusion of its most recent fiscal quarter were no one-time fluke, company executives told attendees, HP has a plan in place to turn that dip around.

The iconic hardware maker is well aware how much is riding on the success of those efforts. Investors attracted to the profitability of print supplies attach enormous importance to HP’s supplies income—so much importance, in fact, that HP made a public commitment to them in 2015 when it split off from the former Hewlett Packard that it would return its then troubled supplies business to growth by the end of the 2017 fiscal year. In the end, it not only kept that promise but did so two quarters ahead of schedule.

“We maintained growth on a quarterly basis globally in the supplies business through the second half of ’17, and every quarter through 2018,” notes David Lary, vice president of supplies sales for the Americas at HP.

That streak came to a close, however, in the first quarter of the current fiscal year, with supplies revenue dropping 3 percent globally to $3.3 billion. “We missed,” Lary says. “We no longer were able to hit that commitment to grow supplies.” Worse yet, he continues, HP lowered previously-set expectations for the rest of the year.

“Rather than being kind of flat to slightly up for the bulk of the year, we will actually continue to be down,” Lary says.

The news sent HP shares tumbling more than 17 percent the next day, and prices have been largely flat since then. CEO Dion Weisler acknowledged the issue during his Reinvent keynote yesterday.

“I’m not happy with how we started the year on supplies, and we need to get that business back on track,” he said. “You will see us take clear and decisive action to course correct as needed.”

Before describing the action partners can expect to see in the Americas, Lary emphasizes two important points. First, though sales of print supplies may be ailing, HP’s print business overall is healthy. Indeed, it generated $821 million of profit in Q1, equivalent to 16.2 percent of revenue.

Second, the global numbers in HP’s latest quarterly report were skewed by a deeper, more localized challenge in Europe, where supplies revenue dropped 9 percent. “In the Americas, we actually declined but it was very little,” Lary says. “We were just slightly down.”

Even so, he continues, there’s no denying that HP’s print supplies operation is struggling against multiple long-term headwinds. For starters, there are fewer and fewer printers in need of supplies these days. “The amount of printers out there is steadily declining,” Lary notes, adding that owners of those devices are using them less than they once did as well.

Additionally, companies in need of supplies are increasingly buying them either from Amazon or from smaller websites offering HP-compatible products at cut-rate prices. “Half of all supplies are purchased online today,” Lary says.

To combat those trends, HP plans to take a page from the larger strategy it’s using to meet changing market conditions and promote subscription-priced, as-a-service purchasing options.

“We’re going to continue to push hard to convert or transition the [supplies] business from a transactional-oriented business to a more contractual-oriented business,” Lary says, adding that customers who enjoy the convenience of automatic consumables replenishment have little reason to buy cheap remanufactured supplies online.

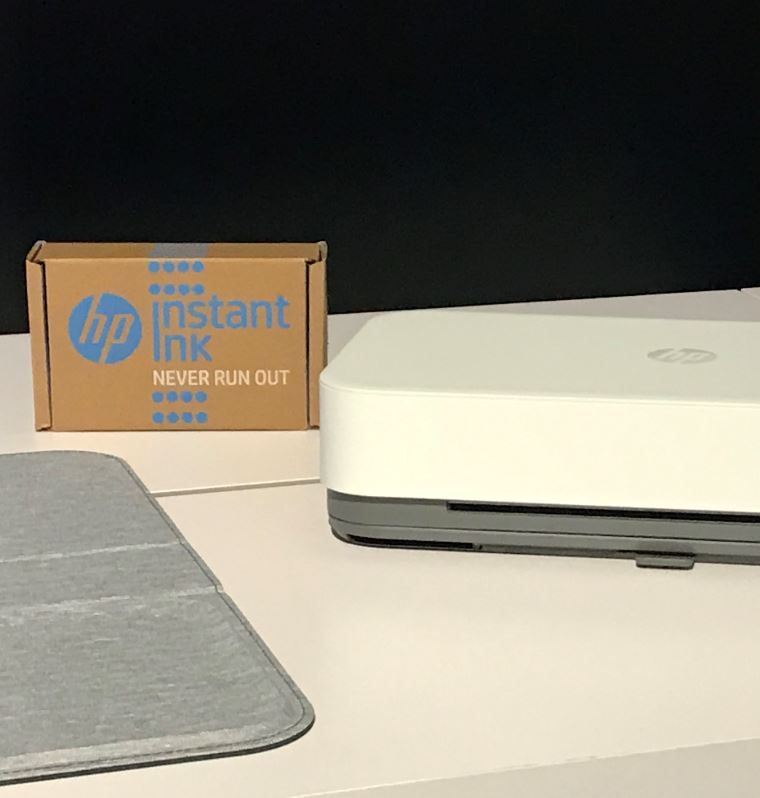

At the consumer end of the market, that effort will focus on driving more HP printer owners to sign up for the company’s Instant Ink subscription program, which sends fresh ink to members automatically in exchange for subscription fees that vary by how many pages they print per month. In the commercial segment, the emphasis will be on managed print offerings delivered either directly by HP itself to larger businesses or through leading distributors to small and midsize buyers.

According to Lary, HP is also working diligently to help ink and toner resellers beat online retailers at their own game. “We are investing in digital assets and capabilities to enable our loyal partners be much more effective selling online,” he says. Those efforts range from providing electronic marketplace design tips to distributing professionally-prepared sales and marketing content and taking steps to keep partners from underselling one another.

“We have implemented minimum advertised pricing policies,” Lary states.

To further boost demand for certified printer supplies, he adds, HP is also aggressively rolling out marketing campaigns that tout the superior quality, reliability, and environmental sustainability of those products.

How long it’ll take such measures to push supplies sales upward again is uncertain, but an understandably constant preoccupation for HP’s entire print organization.

“That’s the knob that my team wakes up and is concerned about [turning] every day,” Lary says.