BlackPoint Cyber has added integration with Microsoft Defender for Endpoint (MDE), vulnerability scanning, and protection for devices running macOS to its managed detection and response solution.

All three enhancements, which are available now at no extra cost to MDR subscribers, reached market alongside a new option to purchase coverage through the vendor’s BlackPoint RISK cyber insurance offering via third-party brokers.

Like existing integrations with solutions from Bitdefender, Malwarebytes, SentinelOne, and others, the link to MDE gives BlackPoint software and analysts access to alerts and other telemetry from a widely used endpoint protection solution. MDE has been included in the Business Premium edition of Microsoft 365 as part of a larger service called Microsoft Defender for Business since May.

“There’s a lot of folks that use [MDE] because they were already paying for it in their Business Premium subscription,” notes Jon Murchison, BlackPoint’s CEO. Integrating the BlackPoint Cyber platform with MDE helps MSPs capture the extra margin that arrangement makes possible, he continues, and makes administering the Microsoft service easier for technicians.

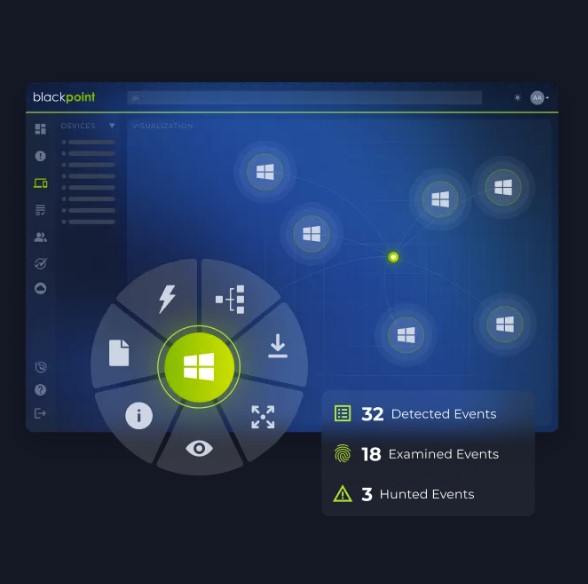

“The [MDE] user interface is tough to manage for an MSP, so we built a whole orchestration layer on top,” Murchison says, noting that BlackPoint’s management console, unlike Microsoft’s, is multitenant and supports popular endpoint security and EDR solutions from other software makers.

Security vendor Huntress shipped a managed Microsoft Defender service last October. Kaseya’s RocketCyber unit offers a similar service that will be incorporated in Datto’s forthcoming managed SOC solution.

BlackPoint’s new vulnerability scanning feature inventories weaknesses associated with one or more external IP addresses, either on command or at pre-scheduled intervals. MSPs can then share the system’s customer-ready reports with existing clients or companies in their sales funnel.

“Most MSPs use vulnerability management for prospecting,” Murchison observes.

BlackPoint is developing a continuous vulnerability management solution, currently slated to reach market early next year, that will watch for issues 24/7 and feed what it finds directly to the company’s SOC. IGI CyberLabs and SOCSoter provide similar functionality through an alliance and integration in place since February.

BlackPoint’s macOS agent, its first such offering, is designed to help MSPs secure Apple endpoints without help from third-party macOS security tools. Mac shipments worldwide grew 29.1% year over year in 2020 and another 22.1% in 2021, according to IDC, spurred partly by the trend toward remote work on personal and bring-your-own devices brought about by the coronavirus pandemic.

First launched some two years ago, BlackPoint RISK lets channel pros buy cyber insurance protection for themselves and their customers directly from BlackPoint. Policies include coverage for crisis management, customer notifications, credit monitoring, forensic investigations, and public relations, among other expenses.

The service is backed by five major insurance carriers who draw on input from BlackPoint’s MDR solution to offer discounted pricing. Trend Micro, IGI CyberLabs, and Augmentt, among others, similarly help MSPs procure cyber insurance for customers at reduced rates through data-sharing agreements with outside carriers.

The new addition to RISK added this month makes policies available through retail insurance brokers, in addition to BlackPoint itself, for the first time. “A lot of MSPs trade leads with their insurance brokers,” Murchison says. “We don’t want to disrupt that relationship.”

The new policies offer higher limits up to $35 million as well, plus both Errors & Omissions and Directors & Officers coverage.

Cyber insurance prices in the U.S. rose 79% in the second quarter of 2022, according to broker and risk advisor Marsh. High prices and stricter underwriting standards are increasingly putting cyber insurance out of reach for SMBs and channel pros alike.

“It’s just not healthy,” Murchison says. “If MSPs can’t get insured and get good insurance, they’re playing Russian roulette.”

In addition to MDR and cyber insurance, BlackPoint Cyber has offered a logging and compliance management solution since last June. It added MDR protection for Microsoft 365 and Azure Active Directory a year later. The company plans to layer more services and solutions into what it says will become a steadily more comprehensive platform over time.

“We over tripled our engineering staff in the past 12 months,” Murchison says.