Amazon Web Services sells over 8,000 solutions from more than 1,600 ISVs to some 300,000 monthly fee-paying customers around the world through its AWS Marketplace site. MSPs and other service providers play little direct role in all that activity today, but moves announced by Amazon at its 2020 re:Invent conference offer channel pros an easier way to get in on the AWS ecosystem.

Effective this week, providers of professional services can add offerings to the Marketplace catalog and create bundled listings that let businesses procure and pay for software and associated support through a single integrated invoicing process.

To date, AWS customers in need of one-time or ongoing help with tasks like assessments, migration, deployment, and training have had to research, vet, and transact business with service providers separately. Merging those now distinct processes will make purchasing from Amazon easier and more attractive for end users, the vendor believes.

It also, however, gives service providers access to Amazon’s huge and growing customer base while helping ISVs find and forge relationships with new channel partners, according to Garth Fort, director of product management at AWS Marketplace.

“We want to make it easy for ISVs that come into Marketplace to find highly qualified partners in the channel in the countries that they want to go into,” he says.

There are currently 261 service listings in the Marketplace catalog, mostly from vendors with professional services arms like Cisco and Sophos, giant services firms like Rackspace, and big-time MSPs with national footprints like Presidio. Such companies are likely to account for most of the service listings and generate most of the service revenue going forward, according to Fort, but there’s nothing to stop much smaller channel pros from participating as well.

“It’s open to everybody,” he says, noting that there are no admission fees or minimum requirements to clear other than having a U.S. bank account.

Becoming an authorized seller on AWS Marketplace and creating a professional service offering are relatively quick processes as well, Fort continues. “My guess is that even somebody who’s not really familiar with AWS or Marketplace could, from a cold start, get a professional service listing in the marketplace in less than an hour,” he says. “It’s super straightforward.”

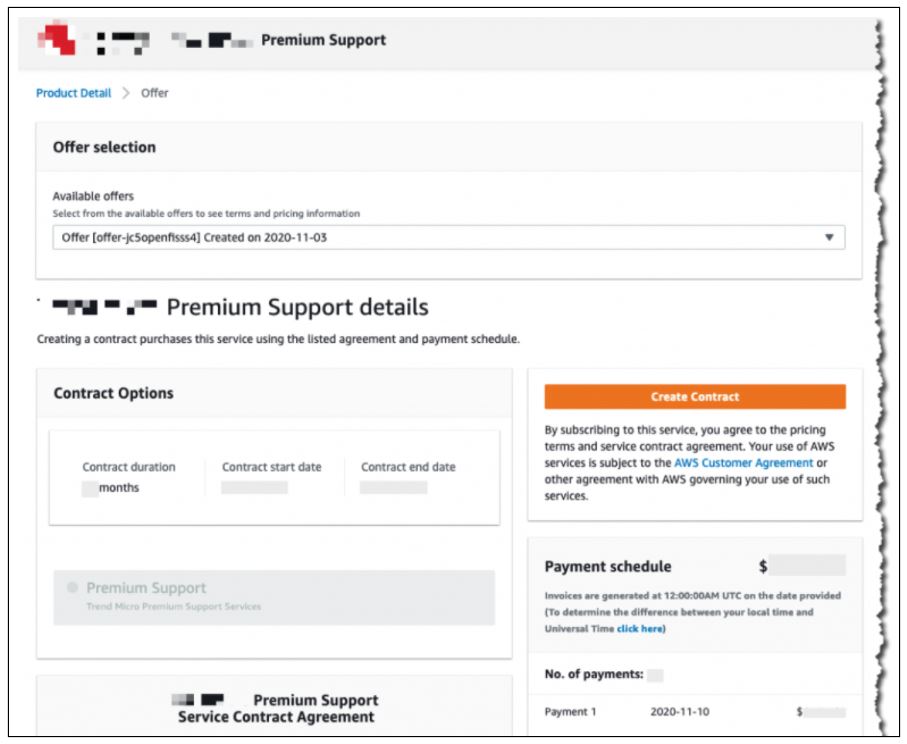

Professional services have been available on AWS Marketplace for just over two years, but only through a heavily manual process that providers could use to create one-time “private offers” for specific customers.

“I have to fill out a form and mail it to my team, and then we create the offer and extend the link to the customer,” Fort says. The new process, by contrast, is self-serve and open to any interested end user. it also makes accounting for service revenues simpler for AWS and its partners, according to Fort.

“In most jurisdictions, the tax rate on labor is significantly lower than the tax rate on software,” he notes. To avoid overpaying state and local governments, however, private offer providers had to calculate how much of their AWS revenue came from services versus software on their own.

“They had to keep track of all this stuff manually in spreadsheets,” Fort says. Private offers remain an option for partners who wish to create them, he adds.

Microsoft is far and away the most popular public cloud platform operator within the SMB channel at present. Over 70% of respondents to ChannelPro’s 2020 State of the Channel survey, for example, sell Office 365 to their clients. AWS, by contrast, has fewer partners with a more strategic mindset, according to Fort.

“They’re less transactional, if you will. They’re less interested in margins off reselling lots of copies of Office,” he says. “They’re more interested in offering things like we can support, where they’re offering value-added services that are higher margin in sort of harder to find skillsets.”

AWS exposes them to an immense set of potential clients, Fort continues. “We have a very long tail of small businesses.”

Marketplace isn’t the only venue for channel pros to reach those businesses. Amazon introduced a service called AWS IQ last September that lets consulting firms and freelancers participate in what Fort calls an Uber-like, work-for-hire AWS “gig economy” as well.

Beginning in January, meanwhile, consulting partners with resellable intellectual property will have access to a new offering announced this week called ISV Partner Path. Aimed principally at full-time software vendors, the program also lets part-time developers tap into guidance, resources, and support for building and selling AWS-based solutions. Members can utilize the associated ISV Accelerate program as well to coordinate go-to-market plans with AWS salespeople.

Microsoft has been similarly encouraging its partners to co-sell Azure-based solutions and services in recent years.

Fueled by the rush to work-from-home computing brought about by the coronavirus pandemic, the global market for cloud services, software, and hardware will climb at a 15.7% CAGR through 2024 to more $1 trillion worldwide, according to IDC.